Yesterday's question: If the Fed lowers the interest rate, what will happen to unemployment and inflation?

OK, everything you needed to answer yesterday's question was in the post. All things equal, a decrease in the interest rate will cause there to be an increase in inflation and a decrease in unemployment. The goal is to stimulate the economy by getting businesses to borrow more to expand production by spending the borrowed money and hiring new workers. This explanation makes the decrease in unemployment clear, but how does this cause inflation?

First we must understand that the United States currency is not backed by gold, silver, or any other commodity for that matter. It is considered fiat money. Which means, it has value because we believe it does. As long as we continue to accept it as a legitimate medium of exchange it will continue to have value. As a result, in our economy we assume that people will get paid based on the value of the contribution to production. In other words, the person who gets paid $7.00 per hour to make fries at the fast food joint is actually contributing $7.00 per hour to production. And the Gross Domestic Product (GDP) of the United States is the sum of all the effort put into production in a given year, measured in dollars. Put another way, GDP is the value of all goods and services produced in a country for a given year. Therefore:

(the sum of all the effort put into production in a given year measured in dollars) = (the dollar value of all goods and services produced in a country for a given year)

When this happens, it is assumed that all the money in the economy is equal to all the goods and services in that economy.

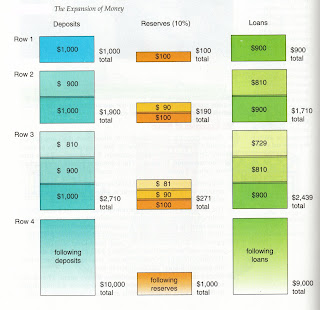

Second, the money that is loaned out reproduces. That is to say, the multiple-deposit system employed by our banking system causes the amount of money to multiply. Remember Macroeconomics 101 (March 18 post), one of the three tools of the Fed is to change the Reserve Ratio. The Reserve Ratio is the percentage of all deposits a bank must keep on hand in order to pay for withdrawals. So, if the reserve ratio is .1 (or 10%), what does the bank do with the remaining 90%? The Answer: Loans it out.

Below is an illustration of the multiplier effect:

As you can see by this illustration, a simple $1,000 deposit will multiply to become $10,000. The formula for the Multiplier effect is:

As you can see by this illustration, a simple $1,000 deposit will multiply to become $10,000. The formula for the Multiplier effect is:

m = 1/R

where m is the multiplier, and R is the reserve ratio.

Therefore, by implementing a loose-money policy, the Fed is allowing for money to be in circulation by encouraging consumers to borrow and spend more money. If we go back to our fiat money about, if there is more money in circulation it will continue to equal the same number of goods and services produced. When this happens it will cost more dollars to by the same number of goods and services than before, thus creating inflation. A calculated risk in order to help boost production and head off unemployment.

But more on the implications of the Fed's policy tomorrow. Until then, listen to this commentary on NPR's "Marketplace" from today. They are warning Ben Bernanke to learn from the past. Just follow the link below.

http://marketplace.publicradio.org/display/web/2008/03/19/70s_parallel/

No comments:

Post a Comment